When it comes to dental implants in Australia, the cost can get a little high. This raises the question, “does insurance cover dental implant cost?” In most cases, dental implants will not be covered by dental insurance in Australia. However, this doesn’t rule out the idea, as some dental insurance plans will cover the part payment. Here is a guide on how to get dental implants covered by medical insurance. You should contact your dental insurance provider and inquire whether they would take charge or contribute to your implant surgery cost.

How Much Do Dental Implants Cost?

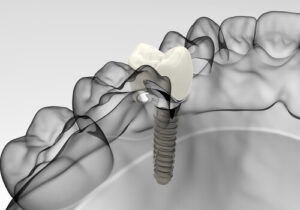

Dental implant cost depends on several factors, from your number of appointments, the material used to construct your dental implants, how many teeth need to be replaced and whether you require a bone graft or sinus lift, your dental implant type, etc. In Australia, the price of a straightforward dental implant can vary between $3,000 – $5,500 per tooth. The current national dental fee survey for 2020 shows that it might reach up to $5,514 per tooth. Additionally, if bone grafting or sinus lifting is necessary before placing a single implant, it could cost you as much as $11,500! Your dentist will explain your payment options in detail once they have assessed what is needed to proceed with the procedure.

How Dental Insurance Coverage Works

In Australia, dental insurance usually needs to be gotten on its own as its termed extra coverage. You would likely find your dental coverage in a health insurance plan.

Dental checkups, X-rays, tooth extractions, root canal treatments, etc., are extras. It is these extras that your dental plan will cover either full or part payment.

Various dental treatments are classified into general and major dental in Australia. Preventive dentistry, like checkups, falls under general dental, and major dental procedures, like dental implants, root canal treatments, etc., fall under major dental.

The plan you settle on depends on your healthcare needs at the moment. As each dental insurance provider is different, some may cover treatments, while others will not, and vice versa. If you are planning to get your dental implants abroad, that may be a whole new topic that you need to consult your insurer with.

What Does Your Insurance Cover?

- Preventative care: Includes routine office visits and professional dental cleaning.

- Basic Restorative care: For dental treatments like fillings and crowns.

- Endodontics: For root canals.

- Oral Surgery: Tooth extractions, tissue biopsy, drainage of bacterial infections, and placement of dental implants.

- Orthodontics: Palatal expanders, braces, aligners, and retainers.

- Periodontics: Scaling, root planing, gum grafting, periodontal surgery, and placement of implants (if certified for implant placement).

- Prosthodontics: Dentures, bridges, and dental implants

According to the National Association of Dental Implants, these procedures are categorised into three coverage groups for payment purposes: preventative care, basic practices, and major operations. Generally, insurance plans will cover 100% of preventive care. Basic dental treatments like tooth extractions, fillings, root canals, and gum disease treatment may be covered at a lower rate, approximately 80% or less.

Dental crowns, dentures, and implants are major procedures that tend to be covered at the lowest percentage, such as 50%. It is common for dental insurance plans to have a waiting period, typically a year or less, before covering major procedures like dental implants. Be sure to speak to your insurance provider about the waiting period and if they cover major dental procedures such as implants.

Does Dental Insurance Cover Implants?

As previously stated, most dental insurance plans will not cover dental implants in Perth. That is because some insurance providers consider dental implants part of cosmetic dentistry.

Dental implants work to return your smile and facial appearance. However, they do more than that in that they restore the function of your teeth and prevent bone loss. Unfortunately, not all dental insurance providers go with that.

On the other hand, some dental insurance providers in Australia will cover part payment of your dental implant treatment. The amount they cover will be based on your dental plan. So don’t hesitate to reach out to them for clarification on the costs they cover.

Different Types Of Dental Insurance

As you may know, the amount your dental plan will cover from your dental implant surgery cost depends on your insurance provider. These are some types of dental insurance you can get in on in Australia.

Dental Preferred Provider Organisation (DPPO)

The dental preferred provider organisation allows patients to select from a list of dentists participating in the program. The organisation contracts these dentists to give discounts on their fees.

As many of these insurance providers allow, getting a DPPO with a non-participating dentist is possible. However, you should note that you will get less coverage with a non-participating dentist than with a participant.

Dental Indemnity

The dental indemnity plan is considered a traditional insurance plan in Australia. It works by reimbursing the insurer for the amount spent on their dental treatment.

In some cases, the reimbursement does not follow the costs charged by the dentist or dental care provider. Rather, it is based on the expenses that the insurance company deems usual and reasonable.

Dental Health Maintenance Organisation (DHMO)

This dental insurance type focuses on preventive dentistry to keep your dental health at its optimum state. You may find the coverage with a DHMO plan drops drastically when it comes to more advanced treatments like dental implants, for instance.

Dental Point Of Service (DPOS)

A dental point-of-service insurance plan is similar to the DPPO and DHMO plans. The insurance plan allows you to get treatment from dentists outside your network, although the coverage will be less.

This insurance plan requires you to select a primary care dentist. So, when this dentist refers you to other professionals or specialists, the insurance will cover the payment for that treatment.

Dental Exclusive Provider Organisation (DEPO)

The DEPO insurance plans can cover the cost of dental care gotten from in-network dentists. It doesn’t require you to get a primary dentist or a specialist referral to avail of the dental coverage.

This insurance plan will not cover out-of-network dentists, but there may be exceptions for dental emergencies. It is a fee-for-service type of insurance so that payment will be made at the time of the treatment and then reimbursed.

Why Most Insurance Companies Won’t Pay For Dental Implants

There are three major reasons why some dental insurance plans do not cover dental implants. Sometimes not at all, and sometimes just a part of the overall cost.

Experimental Procedure

Many dental insurance companies believe that dental implants are experimental. Although this is a farce, there are a lot of companies that tread this path.

Dental implants were first placed over 50 years ago and have been carried out millions of times. The implants are long-lasting and have a whopping 98% success rate. So, the “experimental” card isn’t a valid one.

Cosmetic Dentistry

As mentioned, many dental insurance providers tag dental implants solely for cosmetic purposes and do not cover the treatment. This would be valid since they work to ensure your dental health if dental implants were solely for cosmetic purposes.

Dental implants benefit your health, but some insurance providers believe that dentures or bridges would be an effective solution to missing teeth which is not always the case.

To Avoid Cost

Dental implant surgery costs can run relatively high in Australia. This is the very reason why many of us would rather have them abroad. And the truth remains that these insurance companies aim to profit, so they would rather avoid making such huge investments. In reality, dental implants are a cost-effective procedure as they replace your teeth permanently and are secure, as opposed to dentures that move around your mouth and may need replacements every few years.

Having missing or decayed teeth can make you feel self-conscious about your smile. Luckily, dental implants are a treatment option that can give you a natural smile. While the procedure’s cost may seem daunting at first, a good dental insurance plan can assist in covering the cost. Be sure to check if your current medical insurance or dental insurance includes dental implants. If you have had the plan for over a year, you might be pleased to find out it does!

To schedule an appointment or consultation with the home of digital dentistry here in Sydney, we invite you to contact our friendly team at (02) 9158 6328. We’re well-versed in gentle, caring dentistry with a contemporary twist. As such, our highly skilled team will have your smile looking fabulous and healthy in no time at all.

References:

https://www.colgate.com/en-us/oral-health/implants/how-to-find-dental-insurance-that-covers-implants

https://www.growingfamilybenefits.com/dental-implants-medical-insurance/